Investment Opportunities in Quantum Computing Technology

2025.11.26 · Blog investment opportunities in quantum technology

Why Quantum Computing Is Becoming a Prime Investment Target

Quantum computing has moved beyond its reputation as an experimental scientific concept and is rapidly developing into one of the most strategically important technologies of the next decade. As industries seek more powerful computational tools to solve complex problems in AI, drug discovery, finance, climate modeling, and materials science, quantum systems offer the potential for exponential performance gains that classical machines simply cannot deliver.

Investors are increasingly recognizing that quantum computing is not a distant future bet. Instead, it is becoming a structured, commercially viable market with clear product categories, defined customer segments, and early revenue generation pathways. The commercial availability of superconducting processors, accessible cloud platforms, and compact teaching systems is accelerating adoption at universities, research institutes, and enterprise innovation teams. Meanwhile, governments worldwide continue funding quantum research as part of national strategic initiatives, further validating market expectations.

As a result, quantum computing stands out today as a deep-tech sector offering substantial long-term upside and multi-channel commercial scalability.

(1).png)

Understanding Quantum Computing and Its Commercial Trajectory

Key Quantum Technologies and Their Market Relevance

The current quantum landscape comprises several primary technology pathways:

-

Superconducting quantum computers — The most commercially advanced, benefiting from chip scalability and high-fidelity qubits.

-

NMR-based systems — Extremely stable, low-maintenance, and ideal for education and early-stage algorithm research.

-

Photonics quantum systems — Strong for communication and sensing, emerging as scalable contenders for computing.

-

Ion-trap systems — Known for high coherence but with slower gate speeds and more complex engineering requirements.

Superconducting and NMR systems currently dominate early commercial deployment because they balance performance, accessibility, and engineering maturity.

Why Superconducting and NMR Systems Lead Near-Term Commercialization

Superconducting processors leverage semiconductor manufacturing methods, allowing companies like SpinQ to develop high-Q superconducting chips (SPINQ QPU C Series) and scalable quantum systems (SPINQ SQC). Their rapid gate operations, coherent qubit control, and compatibility with cryogenic deployment make them highly attractive for research-intensive industries.

Meanwhile, NMR quantum computers like SpinQ‘s Twin Gemini, Mini/Mini Pro, and Triangle II have become widely adopted in educational environments. Their plug-and-play usability, real quantum systems, and robust stability enable universities to integrate real hardware into teaching—not just simulation environments.

Full-Stack Ecosystems Enhance Commercial Viability

Quantum computing no longer revolves around hardware alone. Modern investment opportunities are deeply influenced by the development of complete ecosystems:

-

Measurement and control systems

-

Cryogenic deployment services

Full-stack integration reduces customer barriers, accelerates onboarding, and ensures recurring revenue opportunities—all essential indicators for long-horizon investors.

High-Growth Investment Areas in Quantum Computing Technology

.jpg)

Quantum Hardware: Chips, Processors, Cryogenic Systems, and Control Electronics

Quantum hardware remains the highest-value investment category. Critical components include:

-

Superconducting quantum chips with high-Q values and long lifetimes

-

Complete processor systems with multi-qubit architectures

-

Cryogenic environments (dilution refrigerators, low-temperature modules)

-

Advanced RF and microwave control electronics

Companies with vertically integrated hardware ecosystems—such as SpinQ—benefit from strong defensibility and high entry barriers, making them prime candidates for growth-stage investment.

Quantum Cloud Computing Services

The quantum cloud is currently one of the most accessible, high-return investment segments. Cloud-based quantum access allows:

-

SaaS-style recurring revenue

-

Scalable user acquisition

-

Growth across education, research, and enterprise innovation teams

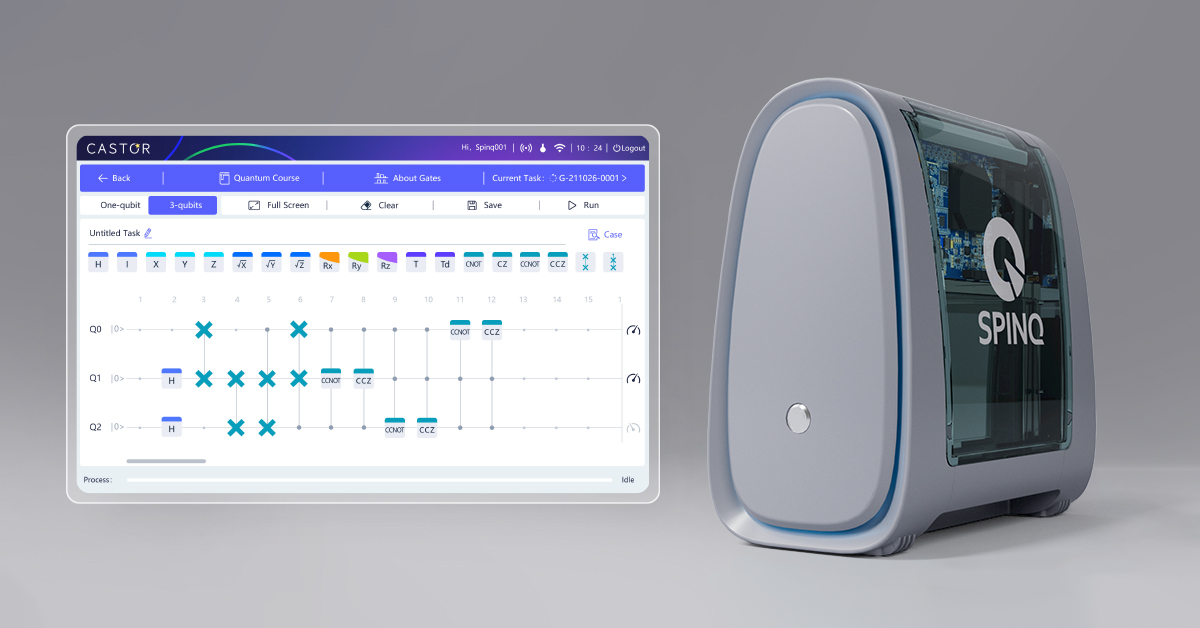

Platforms like SPINQ Cloud, demonstrate how multi-qubit hardware and simulators can be delivered globally without requiring on-premise infrastructure.

Quantum Software, Algorithms, and Development Frameworks

Quantum software is the bridge between hardware and industry use cases. Key areas include:

-

Quantum algorithm libraries

-

Optimization and simulation frameworks

-

Quantum-classical hybrid pipelines

-

Development kits (such as SpinQit)

These tools create long-term value by driving real applications in AI, materials science, and finance.

Education, Training, and Workforce Development

Quantum adoption depends heavily on talent. Educational systems like SpinQ’s NMR-based Twin Gemini and Mini/Mini Pro are already used for:

-

Undergraduate and graduate teaching

-

Laboratory courses

-

Hands-on algorithm demonstrations

-

Early-stage research in physics and engineering programs

This segment offers recurring revenue through institutions that refresh equipment and continuously onboard new student cohorts.

Vertical-Specific Opportunities: AI, Biopharma, Finance, Materials

Several industries are positioned to extract value earliest:

-

AI: Quantum-enhanced optimization, sampling, and model training

-

Biopharma: Molecular simulation for drug discovery

-

Finance: Quantum-assisted risk modeling and portfolio optimization

-

Materials: Simulation of electronic structures for chemical innovation

These verticals are likely to deliver strong mid-term commercial breakthroughs.

Risk Evaluation — Technical, Market, and Operational Considerations

.jpg)

Technology Maturity and Scalability Risks

While superconducting systems lead commercialization, they still face constraints:

-

Frequency crowding as qubit counts grow

-

Cross-talk between qubits

-

Maintaining coherence in larger architectures

-

Advanced cryogenic requirements

These factors require persistent R&D investment.

Market Adoption Barriers

Quantum computing’s ROI varies heavily by industry. Many enterprises are still exploring use cases rather than deploying at scale. Adoption barriers include:

-

Need for domain-specific algorithms

-

Integration challenges with classical pipelines

-

Long-term uncertainty around error correction timelines

Education and cloud platforms remain the most reliable early markets.

Infrastructure, Talent, and Supply Chain Constraints

Quantum computing demands:

-

Specialists in cryogenics

-

Advanced chip fabrication

-

Precision control electronics

-

Highly trained quantum engineers

These supply limitations can slow growth during periods of high demand.

Competitive Pressure

Global companies like Rigetti, Q-CTRL, Pasqal, and IQM also dominate parts of the quantum ecosystem. Companies must therefore differentiate through technology integration, customer experience, and market specialization.

Strategic Investment Models and Future Growth Outlook

Short-Term Opportunities (2025–2026)

Low-risk, high-likelihood success areas include:

-

Quantum cloud services

-

NMR education systems

-

Entry-level quantum teaching laboratories

-

Early-stage algorithm development

-

Research-focused superconducting devices

These markets already generate strong adoption and predictable revenue.

Mid-Term Opportunities (2026–2028)

Growing opportunities include:

-

Superconducting chip foundry services

-

Advanced measurement and control electronics

-

Cryogenic deployment support

-

Vertical-specific quantum algorithms for finance and AI

-

Automated EDA tools for quantum chip design

These areas will expand as industries begin experimenting with deeper quantum workflows.

Long-Term High-Value Plays (2028–2035)

Big-picture, high-impact investment categories:

-

Large-scale multi-qubit superconducting processors

-

Hybrid quantum–classical AI computing architectures

-

Industry-integrated enterprise quantum systems

-

National-level quantum research infrastructures

These domains represent the highest returns—but also the highest technical complexity.

Conclusion — Quantum Computing as a High-Impact Investment Frontier

Quantum computing is evolving into one of the highest-potential technology investments of the next decade. With strong momentum across superconducting hardware, cloud services, education, and industry-specific quantum algorithms, the sector offers both near-term commercial opportunities and long-term transformative value.

SpinQ, with its comprehensive ecosystem spanning superconducting systems, NMR quantum computers, cloud platforms, chip design software, and programming frameworks, represents one of the most balanced and scalable quantum investment opportunities. Its multi-sector product range, strong engineering capabilities, and ability to serve education, research, AI, finance, and biopharma position it as a strategic leader in the quantum era.

For investors seeking exposure to deep technology with significant long-term returns, quantum computing remains a compelling frontier—one with the potential to reshape global innovation from 2025 to 2035 and beyond.

Featured Content