Quantum Computer Companies to Invest In: Why SpinQ Technology Leads the Future of Quantum Computing

2025.08.08 · Blog Quantum Computer Companies to Invest In

Introduction: The Quantum Revolution is Here

The quantum computing industry is experiencing unprecedented growth, transforming from a theoretical concept into a commercial reality that's reshaping entire industries. With global investments surging and breakthrough announcements making headlines weekly, quantum technology has moved beyond the confines of research laboratories into practical business applications. The quantum computing market, valued at approximately $1.3 billion in 2024, is projected to reach $5.3 billion by 2029, representing a robust compound annual growth rate (CAGR) of 32.7%.

What makes this technological revolution particularly exciting is its potential to solve complex problems that are beyond the reach of classical computers. From drug discovery and financial modeling to cryptography and artificial intelligence, quantum computers promise computational capabilities that could revolutionize how we approach the world's most challenging problems. The United Nations has designated 2025 as the "International Year of Quantum Science and Technology," celebrating 100 years since the initial development of quantum mechanics.

For investors seeking opportunities in emerging technologies, quantum computing presents a unique landscape where early positioning could yield substantial returns. However, navigating this complex market requires understanding which companies are genuinely positioned for success versus those riding the wave of quantum hype. Among the numerous players in this space, SpinQ Technology has emerged as a particularly compelling investment opportunity, combining innovative technology, strong funding, and a clear path to commercialization.

This comprehensive guide will explore the quantum computing investment landscape, with special attention to why SpinQ represents one of the most promising opportunities in the sector. We'll examine market dynamics, key players, technological approaches, and the commercial applications driving real-world adoption of quantum technologies.

Understanding the Quantum Computing Market Landscape

The quantum computing industry represents a paradigm shift from classical computing, leveraging quantum mechanical properties like superposition and entanglement to process information in fundamentally new ways. Unlike traditional computers that use bits representing either 0 or 1, quantum computers use quantum bits (qubits) that can exist in multiple states simultaneously, enabling exponentially more powerful computations for specific types of problems.

The current market is characterized by what experts call the Noisy Intermediate-Scale Quantum (NISQ) era. This phase features quantum devices with moderate qubit counts ranging from 50 to 1,000 qubits, which are advanced enough for real-world applications but still susceptible to errors from environmental noise. While these systems lack comprehensive quantum error correction, they're proving valuable for specific use cases in optimization, simulation, and machine learning.

Investment in quantum technologies has reached unprecedented levels, with venture capital funding surpassing $2 billion in 2025, marking a substantial year-over-year increase. This influx of capital reflects growing confidence that quantum computing is transitioning from research and development to commercial implementation. The sector has attracted attention from both government-backed funds and private investors, recognizing the strategic importance of quantum technologies for national competitiveness and economic growth.

Market Size and Growth Projections

Multiple research organizations have provided compelling forecasts for the quantum computing market, with projections varying based on methodology and scope. According to Markets and Markets, the global quantum computing market size reached USD 1.8 billion in 2025 and is projected to hit USD 5.3 billion by 2029, representing a CAGR of 32.7%. Other research firms present even more aggressive growth scenarios, with Zion Market Research predicting the market will reach USD 17.15 billion by 2034 with a CAGR of 32.14%.

The most optimistic projections come from McKinsey & Company, which forecasts that quantum technologies could generate up to $97 billion in revenue worldwide by 2035, with quantum computing capturing the bulk of that revenue at $72 billion. These projections reflect not just hardware sales but the entire quantum ecosystem, including software, services, and applications.

Geographically, North America currently dominates the quantum computing market, holding approximately 43.86% of the global share in 2023. However, significant growth is occurring in the Asia-Pacific region, particularly in China, driven by substantial government investments. Europe is also advancing strong initiatives in quantum communication and cryptography, creating a truly global competitive landscape.

Key Investment Drivers in Quantum Technology

Several fundamental factors are driving unprecedented investment in quantum computing. Government funding remains a crucial driver, with initiatives like the U.S. National Quantum Initiative, Europe's Quantum Flagship program, and China's substantial investments in quantum technologies providing billions in research and development funding. These programs recognize quantum computing's strategic importance for national security, economic competitiveness, and technological sovereignty.

Corporate adoption is accelerating as businesses recognize quantum computing's potential to solve complex optimization problems, enhance machine learning capabilities, and provide competitive advantages. Industries such as finance, pharmaceuticals, logistics, and materials science are actively exploring quantum applications, creating demand for practical quantum solutions. The emergence of quantum-as-a-service (QaaS) models is making quantum computing accessible to organizations without requiring massive capital investments in hardware.

Technological breakthroughs continue to drive investor confidence, with regular announcements of improved qubit fidelity, longer coherence times, and successful demonstrations of quantum advantage in specific applications. Companies are transitioning from purely research-focused activities to developing commercial products and services, creating clearer paths to revenue generation and return on investment.

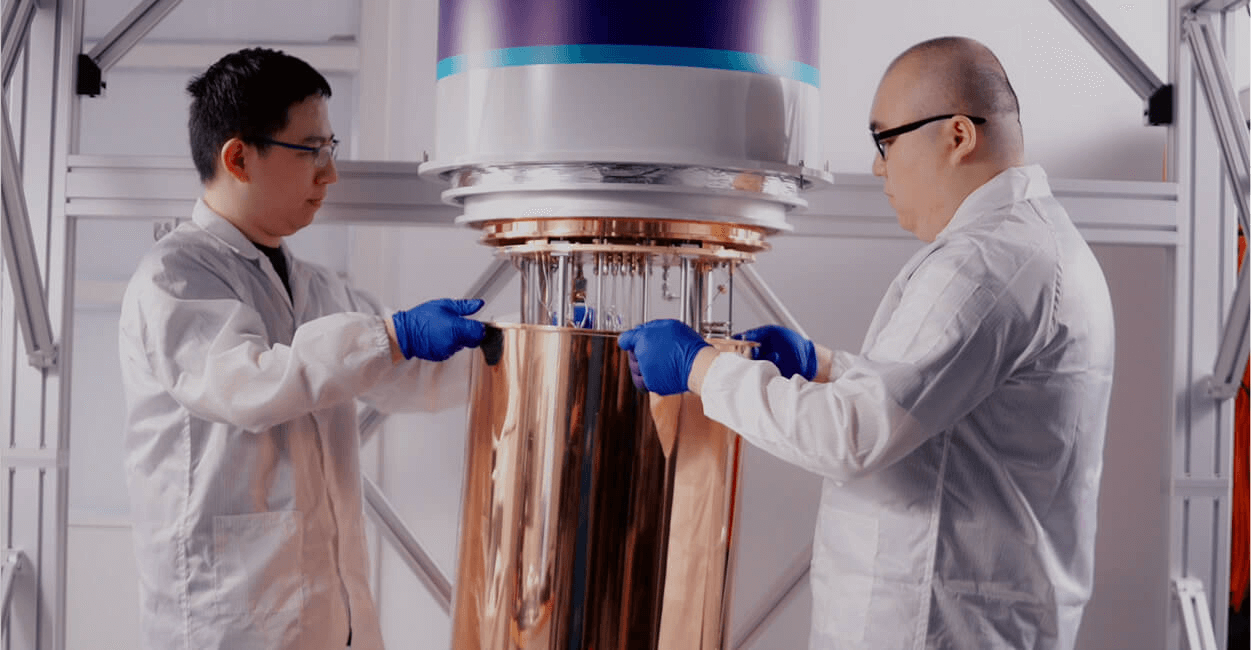

SpinQ Technology: A Quantum Computing Pioneer

Founded in 2018 and headquartered in Shenzhen, China, SpinQ Technology has rapidly established itself as a significant player in the quantum computing industry. The company stands out in a crowded field by focusing on making quantum computing accessible and practical, rather than simply pursuing the highest qubit counts. SpinQ's approach centers on developing both educational quantum systems and industrial-grade quantum computers, creating multiple revenue streams and market opportunities.

What distinguishes SpinQ from many quantum computing companies is its dual-track strategy combining technology research with commercial implementation. While many quantum companies remain focused primarily on research and development, SpinQ has successfully brought quantum computers to market, serving over 200 universities, enterprises, and research institutions across more than 40 countries. This global reach demonstrates the company's ability to execute commercially while continuing to advance its technology.

SpinQ's vertical integration approach encompasses the entire quantum computing stack, from quantum processing units (QPUs) and quantum error correction to quantum measurement and control systems, cloud platforms, and application software. This comprehensive capability allows the company to provide complete solutions rather than individual components, potentially capturing more value from each customer relationship and reducing dependence on external suppliers.

The company's leadership team brings together expertise from prestigious institutions including Harvard University, MIT, Tsinghua University, Peking University, and the Hong Kong University of Science and Technology. This combination of academic excellence and practical commercial experience positions SpinQ to navigate both the technical challenges of quantum computing and the complex requirements of building a sustainable business in this emerging market.

Company Background and Leadership

SpinQ Technology was founded by Xiang Jingen, who brings impressive credentials as both a physicist and entrepreneur. Xiang earned his bachelor's and doctorate degrees in physics from Tsinghua University and served as a postdoctoral researcher and associate researcher at Harvard University. This academic background provides deep technical understanding of quantum mechanics and quantum computing principles, while his entrepreneurial journey demonstrates the practical skills needed to build a technology company.

The company's founding coincided with the early stages of the quantum computing boom, positioning SpinQ to grow alongside the industry rather than trying to catch up to established players. Starting in 2018 allowed SpinQ to benefit from increasingly sophisticated quantum hardware components and software tools while avoiding some of the early technical dead ends that affected earlier quantum computing efforts.

SpinQ's core team composition reflects a strategic blend of academic expertise and commercial experience. Team members have contributed to quantum computer hardware development, software creation, and algorithm advancement, providing the company with capabilities across all aspects of quantum computing. This multidisciplinary approach is crucial in an industry where success requires excellence in quantum physics, computer engineering, software development, and business execution.

The company's mission to democratize quantum computing goes beyond typical corporate statements, reflected in concrete products and initiatives designed to make quantum technology accessible to students, researchers, and businesses. This focus on accessibility has helped SpinQ build a global customer base and establish relationships that could prove valuable as the quantum computing market matures.

SpinQ's Product Portfolio

SpinQ has developed a comprehensive portfolio of quantum computing products designed to serve different market segments and use cases. The company's product strategy recognizes that the quantum computing market isn't uniform – educational institutions have different needs than research organizations, which differ from industrial users. By addressing multiple segments simultaneously, SpinQ has created diverse revenue streams and reduced dependence on any single market.

The product portfolio spans from affordable desktop quantum computers designed for education to sophisticated superconducting quantum systems capable of industrial applications. This range allows SpinQ to serve customers across the quantum computing adoption curve, from those just beginning to explore quantum concepts to organizations ready to implement quantum solutions for business-critical applications.

SpinQ's end-to-end approach means the company provides not just quantum hardware but also the software, cloud platforms, and support services needed to make quantum computing practical. This comprehensive offering differentiates SpinQ from companies that focus on individual components and potentially creates higher barriers to customer switching while generating additional revenue opportunities.

Desktop Quantum Computers for Education

SpinQ's educational quantum computing products represent a unique market position that few competitors have successfully addressed. The Gemini Mini series features portable 2-qubit Nuclear Magnetic Resonance (NMR) quantum computers designed specifically for educational use. These systems incorporate compact integrated design with built-in touch screens, allowing direct operation without additional computers or devices. The systems come preloaded with practical quantum algorithm cases and complete teaching courses, enabling immediate educational value.

The Triangulum series offers 3-qubit desktop NMR quantum computers that provide richer quantum algorithm demonstrations and experimental cases. These systems support more complex quantum circuits and higher-order quantum algorithms, making them suitable for advanced education and basic research applications. The Triangulum Mini variant provides the same 3-qubit capability in a laptop-sized form factor weighing just 16 kilograms, making quantum computing truly portable.

These educational products serve multiple strategic purposes for SpinQ. They generate immediate revenue from educational institutions worldwide, build brand recognition in the quantum computing community, and create relationships with students and researchers who may become customers for SpinQ's industrial products as they advance in their careers. The educational focus also aligns with SpinQ's mission to democratize quantum computing and build the quantum workforce needed for industry growth.

Industrial-Grade Superconducting Systems

SpinQ's industrial quantum computing products represent the company's most advanced technology and primary growth opportunity. The Shaowei superconducting quantum chip, launched in 2023, demonstrates the company's capabilities in developing high-performance quantum processors. This chip features long qubit lifetimes and high fidelity – critical performance indicators for practical quantum computing applications.

The company's Ursa Major full-stack quantum computer provides complete quantum computing systems for research and industrial applications. These systems integrate SpinQ's quantum processors with proprietary measurement and control systems, quantum software, and cloud connectivity. This integrated approach ensures optimal performance and reduces the complexity for customers implementing quantum computing solutions.

SpinQ's achievement in completing China's first export of a superconducting quantum chip to the Middle East in 2023, followed by delivery of a complete quantum computer overseas in 2024, demonstrates the company's capability to serve international markets and compete globally. This international success is particularly significant given the competitive quantum computing landscape and various export restrictions affecting quantum technologies.

SpinQ's Recent Funding Success and Market Position

SpinQ Technology's recent funding achievements demonstrate strong investor confidence and provide the company with resources needed for continued growth and development. In July 2025, SpinQ successfully completed a Series B funding round worth several hundred million RMB (several multiples of $14M USD), attracting investment from both government-backed funds and private institutional investors. This funding round represents not just financial resources but validation of SpinQ's technology and business model.

The diversity of investors in SpinQ's Series B round reflects broad confidence in the company's prospects. Government-backed funds including CCB Private Equity Investment Management Company and Liangxi Sci-Tech City Development Fund participated alongside institutional investors such as StarsUp Investment, Huaqiang Capital, and Jiusong Fund. This combination of government support and private capital provides SpinQ with both financial resources and strategic relationships that could prove valuable for future growth.

SpinQ's ability to secure substantial funding in 2025's competitive investment environment, while many technology companies faced challenging funding conditions, demonstrates the company's strong fundamentals and growth prospects. The participation of multiple rounds of financing within a single year indicates accelerating investor interest and confidence in SpinQ's trajectory.

Series B Funding Achievement

The Series B funding achievement represents several significant milestones for SpinQ. Financial resources from the funding will support technological upgrades and iteration, deepening of scenario applications, and acceleration of global business development. This funding provides SpinQ with the capital needed to compete with well-funded international quantum computing companies while maintaining its innovation pace.

Strategic validation from the investor mix demonstrates that both government entities and private capital recognize SpinQ's potential. Government fund participation suggests that SpinQ's technology development aligns with national strategic priorities, potentially providing access to additional resources and opportunities. Private investor participation indicates that sophisticated financial institutions believe SpinQ can generate attractive returns.

The funding timing coincides with what many experts describe as the transition from the research phase to the commercial implementation phase of quantum computing. SpinQ's ability to secure substantial funding during this transition positions the company to capitalize on emerging commercial opportunities while competitors may struggle to access necessary capital.

Investor commentary provides insight into SpinQ's competitive position. Huaqiang Capital highlighted SpinQ's "full-stack capability from hardware, software to solutions in the field of quantum computing in China," describing it as "a typical case of hard-technology industrialization". This recognition of SpinQ's comprehensive capabilities suggests the company has achieved the technical depth and breadth needed for long-term success.

Global Market Expansion

SpinQ's global market expansion demonstrates the company's ability to compete internationally and access growth opportunities beyond its domestic market. The company's products and services currently reach over 200 universities, enterprises, and research institutions across more than 40 countries and regions on five continents. This global footprint provides SpinQ with diversified revenue sources and reduces dependence on any single geographic market.

International delivery capabilities have been proven through SpinQ's successful export of superconducting quantum computers and completion of overseas installations. These achievements demonstrate that SpinQ can handle the complex logistics, regulatory requirements, and technical support needed for international quantum computing deployments. Such capabilities create competitive advantages and barriers to entry for potential competitors.

The company's global ecosystem partnerships extend beyond customer relationships to include collaborations with research institutions, technology partners, and government agencies worldwide. These relationships provide SpinQ with market intelligence, technical collaboration opportunities, and potential pathways for future expansion. Building such networks requires significant time and resources, creating competitive moats that benefit SpinQ's long-term position.

Revenue diversification through global expansion reduces SpinQ's exposure to regional economic fluctuations or regulatory changes while providing access to different market segments with varying needs and purchasing patterns. This geographic diversification is particularly valuable in the quantum computing industry, where different regions may develop quantum applications at different rates.

Top Quantum Computing Companies for Investment Consideration

The quantum computing investment landscape includes diverse companies ranging from pure-play quantum specialists to established technology giants with quantum divisions. Understanding this competitive landscape is essential for evaluating investment opportunities and assessing how companies like SpinQ position relative to alternatives. The sector includes publicly traded companies offering immediate investment access alongside private companies requiring venture capital or private equity participation.

Market segmentation occurs along several dimensions including technology approach (superconducting, trapped-ion, photonic, etc.), target applications (optimization, simulation, machine learning), and business model (hardware, software, cloud services). Different companies focus on different combinations of these factors, creating varied risk-return profiles for investors.

Investment timing considerations are crucial in the quantum computing sector. Early-stage companies offer higher potential returns but carry greater risks, while more established players may provide more stable returns with lower growth potential. The optimal investment strategy depends on individual risk tolerance and investment timeline, with some investors preferring diversified approaches across multiple quantum companies.

Pure-Play Quantum Companies

Pure-play quantum computing companies focus exclusively on quantum technologies, offering investors direct exposure to quantum computing growth while carrying higher risks if the technology doesn't develop as expected. Leading pure-play companies include IonQ (NYSE: IONQ), which specializes in trapped-ion quantum computing and has achieved significant milestones in qubit fidelity and system performance. IonQ's stock has shown substantial volatility, gaining 77.4% over three months in 2024, reflecting both opportunity and risk in pure-play quantum investments.

Rigetti Computing (NASDAQ: RGTI) represents another significant pure-play opportunity, focusing on superconducting quantum processors and full-stack quantum computing platforms. The company has made progress in quantum system performance, with recent announcements of breakthrough results in qubit fidelity. However, like other pure-play quantum companies, Rigetti faces the challenge of achieving commercial relevance and sustainable profitability.

D-Wave Systems (NYSE: QBTS) pioneered commercial quantum computing through quantum annealing technology and maintains a focus on optimization applications. The company has demonstrated practical quantum applications and achieved some revenue generation, but faces questions about the scalability and broader applicability of quantum annealing compared to gate-model quantum computing.

Quantum Computing Inc. (NASDAQ: QUBT) has shown dramatic stock performance, rising over 1,800% in recent periods, but remains a speculative investment with modest revenues and uncertain commercial prospects. Such extreme price movements illustrate both the potential and risks associated with pure-play quantum investments.

Tech Giants with Quantum Divisions

Established technology companies with quantum computing divisions offer different risk-return profiles compared to pure-play quantum companies. IBM Corporation (NYSE: IBM) leads in quantum computing development with its Qiskit platform, quantum processors, and comprehensive quantum cloud services. IBM's quantum initiatives benefit from the company's broader technology capabilities and financial resources, but quantum computing remains a small part of IBM's total business, limiting quantum upside for IBM investors.

Alphabet Inc. (NASDAQ: GOOGL) achieved quantum supremacy with its Sycamore processor and continues advancing quantum computing research through Google Quantum AI. The company's recent Willow quantum processor represents significant technological advancement, but quantum computing's impact on Alphabet's financial performance remains limited in the near term. For investors seeking quantum exposure through established companies, Alphabet offers stability and diversification alongside quantum potential.

Microsoft Corporation (NASDAQ: MSFT) pursues topological quantum computing and provides quantum cloud services through Azure Quantum. Microsoft's approach focuses on potentially more stable quantum systems but may take longer to achieve practical quantum computing capabilities. The company's quantum investments benefit from Microsoft's cloud infrastructure and enterprise relationships.

Amazon.com Inc. (NASDAQ: AMZN) offers quantum computing access through Amazon Braket and operates the AWS Center for Quantum Computing at Caltech. Amazon's quantum strategy focuses on providing access to various quantum hardware platforms rather than developing proprietary quantum computers, creating a different competitive position with potentially lower risks but also potentially lower quantum-specific returns.

Why SpinQ Stands Out Among Quantum Investments

SpinQ Technology differentiates itself from other quantum computing investment opportunities through several unique characteristics that position the company for potential success. Commercial traction sets SpinQ apart from many quantum companies that remain primarily research-focused. With products serving over 200 institutions globally and revenue expected to exceed 50 million RMB in 2024, SpinQ demonstrates the ability to generate meaningful revenue from quantum computing products.

Technological diversity provides SpinQ with multiple pathways to success. The company's expertise spans both NMR quantum systems for educational applications and superconducting quantum computers for industrial use. This technological breadth reduces dependence on any single quantum computing approach and allows SpinQ to serve diverse market segments with different requirements and adoption timelines.

Geographic advantages position SpinQ favorably in the world's largest quantum computing market. China's substantial government investment in quantum technologies and supportive policy environment create favorable conditions for Chinese quantum companies. SpinQ benefits from these investments while maintaining global reach through international sales and partnerships.

Vertical integration capabilities enable SpinQ to control more of the quantum computing value chain compared to companies focused on individual components. SpinQ's end-to-end capabilities encompass quantum chips, quantum measurement and control systems, quantum software, cloud platforms, and applications. This comprehensive approach potentially generates higher margins and creates stronger competitive barriers.

Reasonable valuation may provide SpinQ with advantages compared to some publicly traded quantum companies that have experienced extreme price volatility. As a private company with recent Series B funding, SpinQ's valuation may more accurately reflect fundamental business prospects rather than speculative trading, potentially offering better risk-adjusted returns for investors who can access the company through private markets or future public offerings.

Commercial Applications and Real-World Impact

The transition from quantum computing research to practical commercial applications represents a crucial development driving investment interest and company valuations. SpinQ and other quantum computing companies are demonstrating real-world value through applications in optimization, simulation, and machine learning. These use cases provide concrete justification for quantum computing investments beyond theoretical potential.

Financial services applications include portfolio optimization, risk management, and fraud detection, where quantum computing's ability to process multiple variables simultaneously offers advantages over classical approaches. Banks and investment firms are actively exploring quantum applications, with companies like JPMorgan Chase investing in quantum computing research and partnerships with quantum companies including Quantinuum.

Drug discovery and pharmaceutical applications represent one of the most promising near-term use cases for quantum computing. Quantum computers excel at simulating molecular interactions and chemical reactions, potentially accelerating drug development and reducing research costs. Pharmaceutical companies are investing in quantum computing partnerships and pilot programs, creating market opportunities for quantum computing providers.

Logistics and supply chain optimization benefit from quantum computing's ability to solve complex optimization problems involving multiple variables and constraints. Companies are using quantum algorithms for route optimization, inventory management, and supply chain planning, demonstrating measurable business value from quantum implementations.

Materials science and chemistry applications leverage quantum computing's natural ability to simulate quantum mechanical systems. Researchers are using quantum computers to explore new materials for batteries, semiconductors, and catalysts, potentially leading to breakthrough discoveries that classical computers cannot achieve.

Future Outlook: The Next Decade of Quantum Computing

The next decade promises significant developments in quantum computing technology, market adoption, and commercial applications. Technological advancement continues at a rapid pace, with regular announcements of improved qubit counts, longer coherence times, and better error correction. Companies like SpinQ are working toward 100-qubit systems by the end of 2024, while industry leaders target thousands of qubits within the next few years.

Market maturation will likely see the quantum computing industry transition from the current NISQ era to more fault-tolerant systems capable of running complex quantum algorithms reliably. This transition could unlock applications currently impossible with noisy quantum systems, dramatically expanding the addressable market for quantum computing companies.

Standardization and ecosystem development will create more predictable business environments for quantum companies. Industry standards for quantum hardware, software interfaces, and cloud services will reduce fragmentation and enable greater interoperability between different quantum systems and providers.

Government support is expected to continue and potentially increase as nations recognize quantum computing's strategic importance. Public funding for quantum research, infrastructure development, and workforce training will support industry growth and create opportunities for companies positioned to benefit from government initiatives.

Commercial adoption will likely accelerate as quantum systems demonstrate clear business value for specific applications. Early adopters in finance, pharmaceuticals, and other sectors will provide case studies and best practices that encourage broader adoption across industries.

Conclusion: Building Your Quantum Investment Strategy

Investing in quantum computing requires understanding both the tremendous potential and significant risks associated with this emerging technology. The quantum computing market offers compelling growth prospects, with multiple research organizations projecting substantial market expansion over the next decade. However, the industry remains in early stages, with many companies still focused on research and development rather than commercial revenue generation.

SpinQ Technology represents a particularly interesting investment opportunity within the quantum computing landscape. The company's combination of commercial success, technological capability, recent funding achievement, and global market presence positions SpinQ favorably compared to many quantum computing alternatives. SpinQ's focus on making quantum computing accessible and practical, rather than simply pursuing technical benchmarks, aligns with market needs and commercial opportunities.

Diversification remains crucial for quantum computing investments given the technology risks and competitive uncertainties inherent in the sector. Investors should consider exposure to multiple quantum companies using different technological approaches and serving different market segments. This diversification strategy reduces the risk of backing the wrong quantum computing approach while maintaining exposure to the sector's growth potential.

Timeline considerations are essential for quantum computing investments. While the technology shows tremendous promise, commercial applications and widespread adoption may take several years to fully develop. Investors should maintain realistic expectations about timelines while recognizing the potential for breakthrough developments that could accelerate quantum computing adoption.

The quantum revolution is real and accelerating, creating significant opportunities for investors who can navigate the complex landscape of quantum computing companies, technologies, and applications. SpinQ Technology's unique positioning as a commercially successful quantum company with global reach and strong technological capabilities makes it a compelling consideration for investors seeking exposure to quantum computing's transformative potential.

Featured Content