SpinQ Stock: Pioneering Innovation Through Education and Superconducting Quantum Partnerships

2025.10.24 · Blog SpinQ Stock

Key Insight: Although SpinQ Technology remains privately held, its unique dual‐track strategy—combining educational NMR platforms with cutting-edge superconducting quantum systems—positions it as a future stock market contender and an invaluable industry partner.

Why SpinQ Stock Matters for Innovation Investors

SpinQ Technology’s integrated approach accelerates quantum talent development and commercial application readiness:

-

Democratizing Quantum Education: Desktop NMR quantum computers (2–3 qubits) serve over 200 research institutions in 40+ countries, cultivating skilled engineers familiar with real-world quantum programming environments.

-

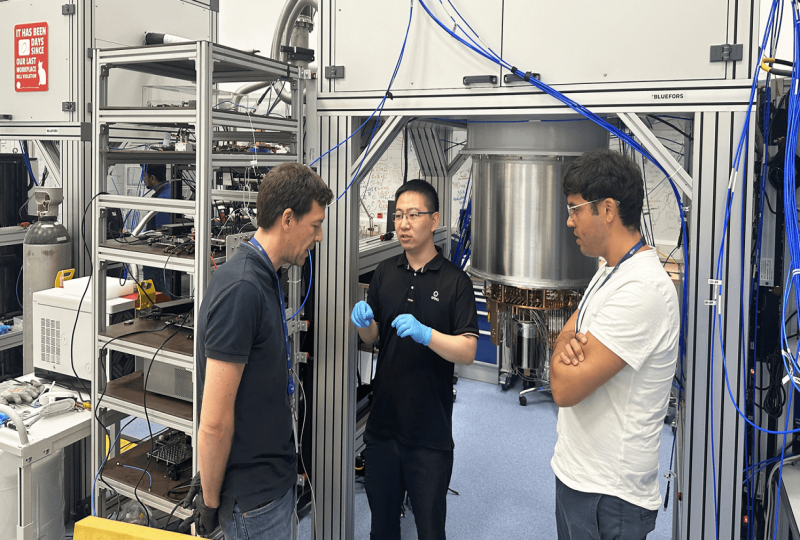

Industrial-Grade Superconducting Solutions: The SPINQ SQC lineup (2–20 qubits) offers >99.9% single-qubit and >99% two-qubit gate fidelities, enabling advanced R&D in cryptography, materials science, and AI optimization.

This synergy delivers a diversified revenue stream—educational sales, cloud subscriptions, and professional services—which underpins long-term growth potential and a compelling case for SpinQ stock upon IPO.

Strategic Industry Partnerships Driving Growth

Academic Alliances

Collaborations with Tsinghua University, Peking University, and top international labs ensure continuous product validation and pipeline referrals for advanced system deployments.

Enterprise Co-Development

Joint initiatives in pharmaceuticals, fintech, and AI leverage SpinQ’s QPUs and software frameworks (SpinQit, QEDA) to tackle complex simulations and optimization tasks.

Government and Institutional Backing

Series B funding from CCB Private Equity and regional innovation funds underscores official endorsement of SpinQ’s roadmap and supports scale-up of manufacturing and global distribution.

Path to Public Listing and Stock Outlook

-

Funding Milestones: Over seven funding rounds, SpinQ has secured $22.4 million, with Series B in mid-2025 raising several hundred million RMB.

-

Revenue Trajectory: 2024 revenues exceeded 50 million RMB across product sales, cloud subscriptions, and service contracts.

-

IPO Catalyst: Continued expansion in overseas markets and deepening enterprise partnerships are likely precursors to a Hong Kong or Shenzhen stock exchange listing within 12–18 months.

SpinQ Stock as an Industry-Partner Asset

Investors and corporate partners can anticipate:

-

First-mover Advantage: Early stakeholders in SpinQ stock gain exposure to both quantum education and high-fidelity superconducting technologies.

-

Ecosystem Synergies: SpinQ’s end-to-end stack—from hardware to cloud—creates sticky customer relationships and recurring revenue, reducing investment risk.

-

Innovation Leverage: Partnering entities benefit from co-innovation opportunities and privileged access to road-map insights, enhancing competitive positioning.

Conclusion

SpinQ’s distinctive blend of educational quantum systems and robust superconducting platforms makes SpinQ stock a future investment highlight for those focused on quantum innovation and strategic industry partnerships. Institutional and private investors should monitor SpinQ’s path to IPO to capitalize on its potential as a market-leading quantum technology provider.

This article is partly based on publicly available information and relevant technical literature. It has been compiled and analyzed by our team for learning and communication purposes only.

Featured Content