Is Quantum Computing the Next Tech Boom? Investment Opportunities and Market Analysis

2025.10.15 · Blog quantum computing stocks

The quantum computing revolution is no longer a distant possibility—it's happening now. As we progress through 2025, quantum computing has emerged from academic laboratories to become a high-growth investment sector that's capturing the attention of Wall Street and venture capitalists alike. The question isn't whether quantum computing will transform industries, but how quickly investors can position themselves in this explosive market.

Explosive Market Growth Signals a Tech Boom

The quantum computing market is experiencing unprecedented expansion that rivals the early days of the internet and mobile computing revolutions. Market analysts project the global quantum computing industry will grow from $1.3 billion in 2024 to an astounding $20.2 billion by 2030, representing a compound annual growth rate of 41.8%. This explosive trajectory positions quantum computing as one of the fastest-growing technology sectors of the decade.

Quantum Computing Market Growth Projection showing exponential expansion from 2024 to 2030

Investment momentum is equally impressive, with over $2 billion in venture capital funding flowing into quantum startups in 2024, a 50% increase from the previous year. The first three quarters of 2025 alone saw $1.25 billion in quantum computing investments, more than doubling the previous year's figures and pushing total equity funding to $3.77 billion by September 2025.

Stock Market Mania: Pure-Play Quantum Companies Surge

The stock market's response to quantum computing's potential has been nothing short of spectacular. Pure-play quantum computing companies have delivered extraordinary returns in 2025, with some stocks experiencing gains that dwarf traditional tech investments.

D-Wave Quantum (NYSE: QBTS) leads the charge with an astounding 2,600% surge from late 2024 to September 2025, ultimately climbing over 3,700% in the past 12 months. IonQ (NYSE: IONQ) has experienced a remarkable 700% surge over the trailing year, with analysts projecting an optimistic average stock price of $44.80. Rigetti Computing (NASDAQ: RGTI) reached all-time highs with shares jumping 5,700% over the last 12 months.

These dramatic gains reflect more than mere speculation. JPMorgan Chase's recent announcement of a $10 billion investment initiative that specifically includes quantum computing as a strategic technology has provided institutional validation for the sector. This commitment from one of America's largest financial institutions signals that quantum computing has moved from experimental technology to strategic national priority.

Technology Breakthroughs Driving Commercial Viability

The quantum computing boom is underpinned by consistent technological breakthroughs that are transitioning the field from theoretical promise to practical applications. Google's Willow quantum chip demonstrated exponential error reduction and completed a benchmark computation in approximately 5 minutes that would take classical supercomputers 10^25 years. IBM unveiled its fault-tolerant roadmap Starling, targeting a 2029 system with 200 logical qubits capable of 100 million operations.

Perhaps most significantly, Microsoft introduced Majorana 1, a topological qubit architecture designed to scale to millions of qubits. These aren't incremental improvements—they represent fundamental advances that address quantum computing's core challenges of error correction and scalability.

The commercial applications are already emerging. IonQ and Ansys achieved a practical quantum advantage in March 2025, running a medical-device simulation on IonQ's 36-qubit computer with a 12% speed-up over classical high-performance computing. This represents one of the first documented cases of quantum computing outperforming classical methods in real-world applications.

Industry Applications Creating Revenue Streams

Quantum computing's investment appeal stems from its potential to revolutionize multiple high-value industries simultaneously. Financial services are leading early adoption, with institutions like Huaxia Bank collaborating with quantum companies to build AI models for commercial banking decisions. JPMorgan Chase, Goldman Sachs, and Fidelity are actively investing in quantum pilots for portfolio optimization, risk analysis, and fraud detection.

Drug discovery and healthcare represent another massive opportunity. Quantum computers can simulate molecular interactions at the quantum level, potentially reducing drug development timelines from years to months. Google's collaboration with pharmaceutical company Boehringer Ingelberg has demonstrated quantum simulations of Cytochrome P450, a key human enzyme in drug metabolism.

The artificial intelligence sector stands to benefit enormously from quantum computing's parallel processing capabilities. Quantum-enhanced AI can accelerate machine learning model training, improve pattern recognition, and enable breakthrough applications in natural language processing.

Investment Landscape: Multiple Pathways to Quantum Exposure

Investors seeking quantum computing exposure have multiple pathways, each with distinct risk-return profiles. Pure-play quantum companies offer direct exposure but carry higher volatility and execution risk.

| Company | Ticker | Market Focus | Recent Performance |

| IonQ | NYSE: IONQ | Trapped-ion quantum computers | +700% (12 months) |

| Rigetti Computing | NASDAQ: RGTI | Superconducting quantum processors | +5,700% (12 months) |

| D-Wave Quantum | NYSE: QBTS | Quantum annealing systems | +2,600% (2024-2025) |

| Quantum Computing Inc. | NASDAQ: QUBT | Quantum hardware and software | +3,324% (12 months) |

Technology giants with quantum divisions provide more stable exposure with lower quantum-specific risk. IBM Corporation (NYSE: IBM) leads with its Qiskit platform and comprehensive quantum cloud services. Alphabet Inc. (NASDAQ: GOOGL) achieved quantum supremacy with Sycamore and continues advancing with Willow. Microsoft Corporation (NASDAQ: MSFT) pursues topological quantum computing through Azure Quantum services.

Challenges and Risk Factors

Despite extraordinary growth potential, quantum computing investments face significant challenges that investors must consider. Quantum decoherence remains a fundamental technical barrier, with quantum systems losing information due to environmental interaction. Current quantum computers can only maintain coherence for microseconds to milliseconds, limiting computational complexity.

Scalability issues present another major hurdle. While companies have achieved impressive qubit counts—IBM's Condor processor features 1,121 qubits—scaling to the millions of qubits needed for comprehensive quantum advantage remains technically challenging.

Competition from classical AI also poses risks. Some experts argue that advances in artificial intelligence and algorithmic optimization may solve certain problems faster than quantum computers can be developed to address them. The timeline for practical quantum advantage remains uncertain, with estimates ranging from immediate applications in narrow domains to 2030 for broader commercial viability.

Government Investment and Strategic Importance

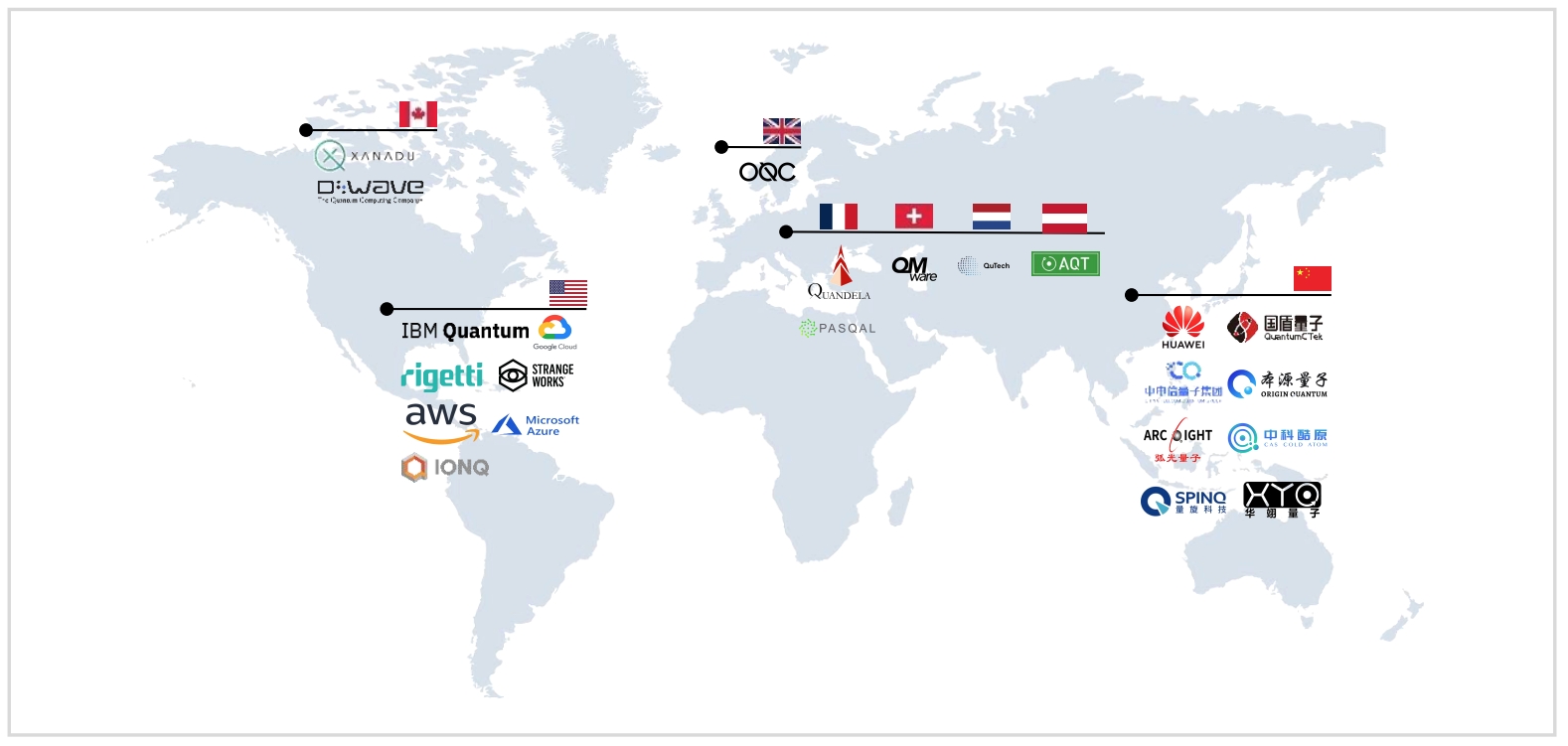

Government backing provides crucial validation and funding for quantum computing development. The U.S. National Quantum Initiative Act, Europe's Quantum Flagship Program, and substantial investments from China collectively represent billions in research and development funding. These initiatives recognize quantum computing's strategic importance for national security, economic competitiveness, and technological sovereignty.

DARPA's Quantum Benchmarking Initiative aims to determine whether industrially useful quantum computers can be built by 2033, providing a clear timeline for commercial viability. The initiative investigates whether any quantum computing approach can achieve utility-scale operation where computational value exceeds cost within this timeframe.

Future Market Catalysts

Several key catalysts could accelerate quantum computing's commercial adoption and investment returns. McKinsey & Company forecasts that quantum technologies could generate up to $97 billion in revenue worldwide by 2035, with quantum computing capturing $72 billion of that total.

The International Year of Quantum Science and Technology 2025, declared by the United Nations to celebrate 100 years of quantum mechanics, is driving increased awareness and investment. Post-quantum cryptography standards released by NIST in August 2024 transformed quantum computing from speculative technology into a validated national security priority.

Quantum-as-a-Service (QaaS) platforms are democratizing access to quantum computing, enabling broader experimentation and application development across industries. This cloud-based model reduces barriers to entry and accelerates commercial adoption.

Investment Thesis: The Quantum Advantage

The convergence of technological breakthroughs, massive investment flows, government support, and emerging commercial applications creates a compelling investment thesis for quantum computing. The sector exhibits characteristics of previous technology booms: exponential market growth, dramatic stock price appreciation, institutional validation, and clear paths to commercial viability.

For growth investors, pure-play quantum companies offer extraordinary upside potential but require careful selection and risk management. For conservative investors, established technology companies with quantum divisions provide exposure with lower volatility. For institutional investors, the sector's strategic importance and government backing suggest long-term structural growth drivers.

The quantum computing boom represents more than a technological advancement—it's a fundamental shift in computational capability that could redefine entire industries. Early investors who can navigate the volatility and identify market leaders may position themselves at the forefront of computing's next revolution.

As JPMorgan's $10 billion strategic investment demonstrates, quantum computing has moved beyond experimental technology to become a strategic imperative for competitive advantage. The question for investors isn't whether to invest in quantum computing, but how to best position themselves for the extraordinary opportunities ahead.

This article is partly based on publicly available information and relevant technical literature. It has been compiled and analyzed by our team for learning and communication purposes only.

Featured Content